Best Investor Database for Raising Capital (2026)

Raising capital is one of the toughest challenges for any startup founder. The good news? There is a whole host of investor databases that can help you to locate the right investor for your fundraise.

But with so many options, which investor database is right for your team? Well, in this article we’re going to break down which investor database is best for you based on each databases standout features, pricing, and more.

Let’s dive in!

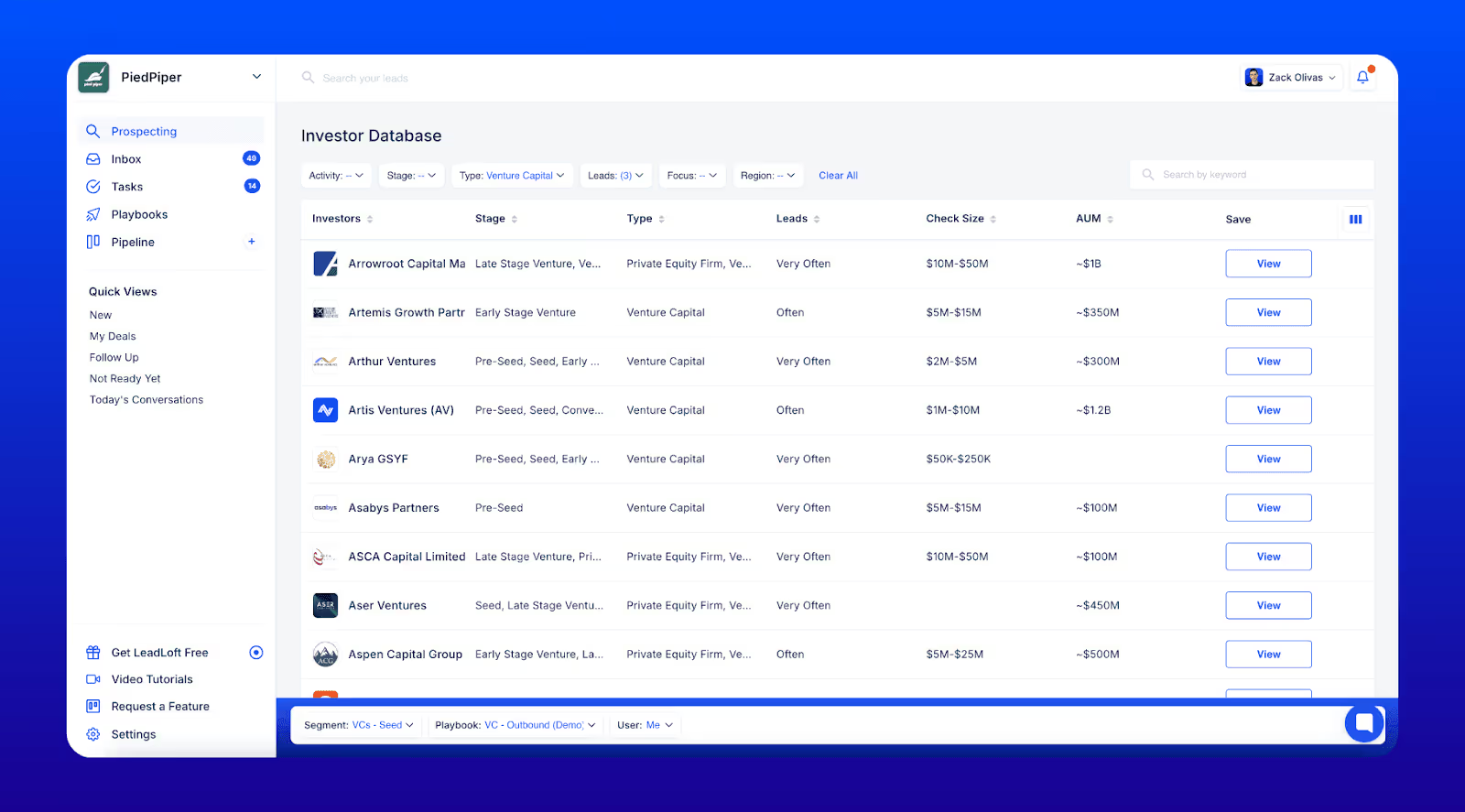

1. LeadLoft

When it comes to raising capital, efficiency is everything. LeadLoft is more than just an investor database, it finds investors, books meetings, and tracks them.

Whether you’re raising a pre-seed round or targeting venture capitalists for a Series A or B, LeadLoft’s comprehensive approach ensures you’re not just connecting with investors but doing it in the most effective way possible.

Why LeadLoft Stands Out

- Comprehensive Investor Data: Access detailed investor profiles, including firm focus, assets under management (AUM), likelihood to lead investment rounds, and contact information.

- Email Finding Made Simple: Automatically find verified email addresses for investors, saving you hours of manual research.

- Automated Outreach: LeadLoft doesn’t stop at helping you find investors. It helps you reach out, follow up, and schedule meetings.

- User Friendly Interface: Built for speed and simplicity. Even if you’re not tech-savvy, LeadLoft will be easy to learn..

- Highly Accurate Data: Constantly updated to ensure you’re not pitching to outdated contacts.

Website: https://www.leadloft.com/

Pricing: $5 - $99/ month

Pros

- Saves tons of time with automation tools.

- Provides actionable insights to target the right investors.

- Combines data, email finding, and outreach in one platform.

- Works seamlessly for both startups and established businesses.

Cons

- Investor data is less precise than databases like PitchBook..

2. Crunchbase

Crunchbase is one of the best known names in the world of investor research. It’s a platform designed to provide detailed information about companies, funding rounds, and investors. While it doesn’t offer built-in outreach or automation tools, Crunchbase excels in providing a huge amount of data for identifying the right investors for your business.

With its global reach, Crunchbase is ideal for startups and businesses that want to research investors by location, investment focus, and portfolio companies. It’s especially useful for uncovering funding trends and ensuring that you’re pitching to investors who are actively looking for opportunities in your industry. Crunchbase is affordable and easy to use, making it a great starting point for teams who are just beginning their fundraising journey.

Why Crunchbase Stands Out

- Massive Dataset: Crunchbase covers investors, startups, and funding rounds worldwide.

- Detailed Investor Profiles: Quickly see an investor’s portfolio, investment trends, and industries they prefer.

- Custom Search Filters: Narrow down your search by location, investment stage, and more.

Website: https://www.crunchbase.com/

Pricing: $99/month

Pros

- Large database with global coverage.

- Intuitive interface for filtering and finding investors.

- Affordable plans for startups.

Cons

- Does not include email finding or outreach capabilities.

- You’ll need to manually verify investor contact details.

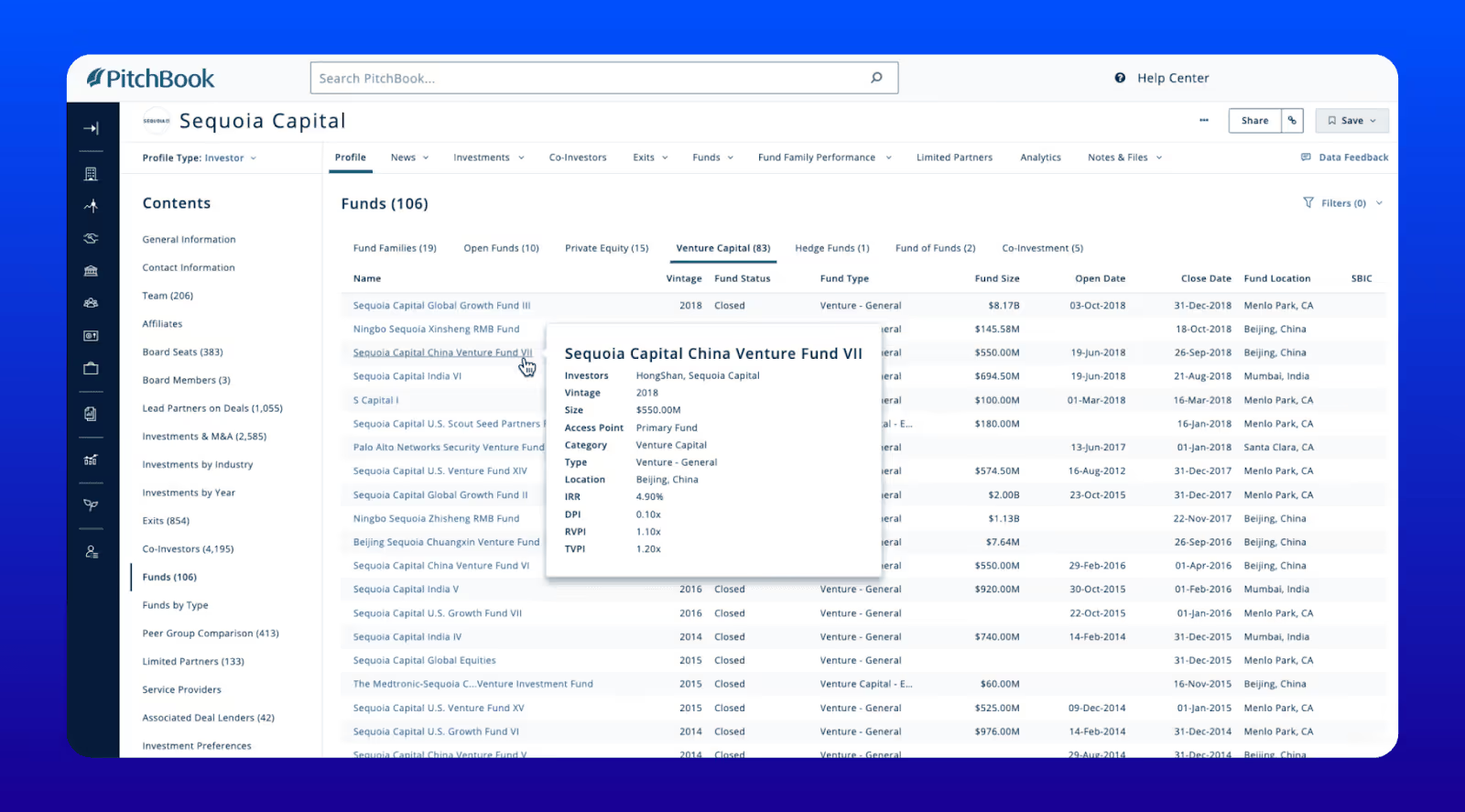

3. PitchBook

PitchBook is the gold standard for businesses that need detailed insights into venture capital, private equity, and mergers and acquisitions. If you’re targeting large institutional investors or planning a major funding round, PitchBook provides everything you need to make informed decisions.

The platform offers an exhaustive dataset that includes investment histories, firm profiles, and even market trends. It’s not just an investor database, it’s a full fledged research tool for businesses that need data backed insights. While it’s pricey, PitchBook’s advanced features make it an excellent option for companies with larger budgets.

Why PitchBook Stands Out

- In Depth Data: Access detailed investment histories, industry trends, and market analysis.

- Global Reach: Covers investors and firms across all major markets.

- Advanced Search Features: Easily find investors who align with your business goals.

Website: https://pitchbook.com/

Pricing: $25,000/year

Pros

- Extremely detailed data for high level analysis.

- Ideal for businesses seeking large funding rounds.

- Reliable for market research beyond fundraising.

Cons

- Very expensive, making it less accessible for startups.

- Not designed for automated outreach.

8. Visible.vc

Visible.vc focuses on helping founders manage investor relations through seamless reporting and updates. While it doesn’t function as a traditional investor database, it’s a crucial tool for keeping current investors informed and engaged. For startups that have already secured funding, Visible.vc helps you maintain transparency and build long-lasting relationships with your backers.

With Visible.vc, you can create visually appealing updates, track performance metrics, and distribute reports directly to your investors. This transparency not only keeps investors happy but also increases your chances of securing follow on funding.

Why Visible.vc Stands Out

- Investor Updates: Simplify communication with investors by sending regular updates and progress reports.

- Customizable Reporting: Use templates and integrations to create professional, data-rich reports.

- Relationship Building: Strengthen your bond with investors by maintaining consistent communication.

Website: https://visible.vc/

Pricing: 129/month

Pros

- Affordable for startups of all sizes.

- Great for post funding relationship management.

- Streamlines investor communication.

Cons

- Not an investor database for finding new contacts.

- Limited to investor relations rather than outreach.

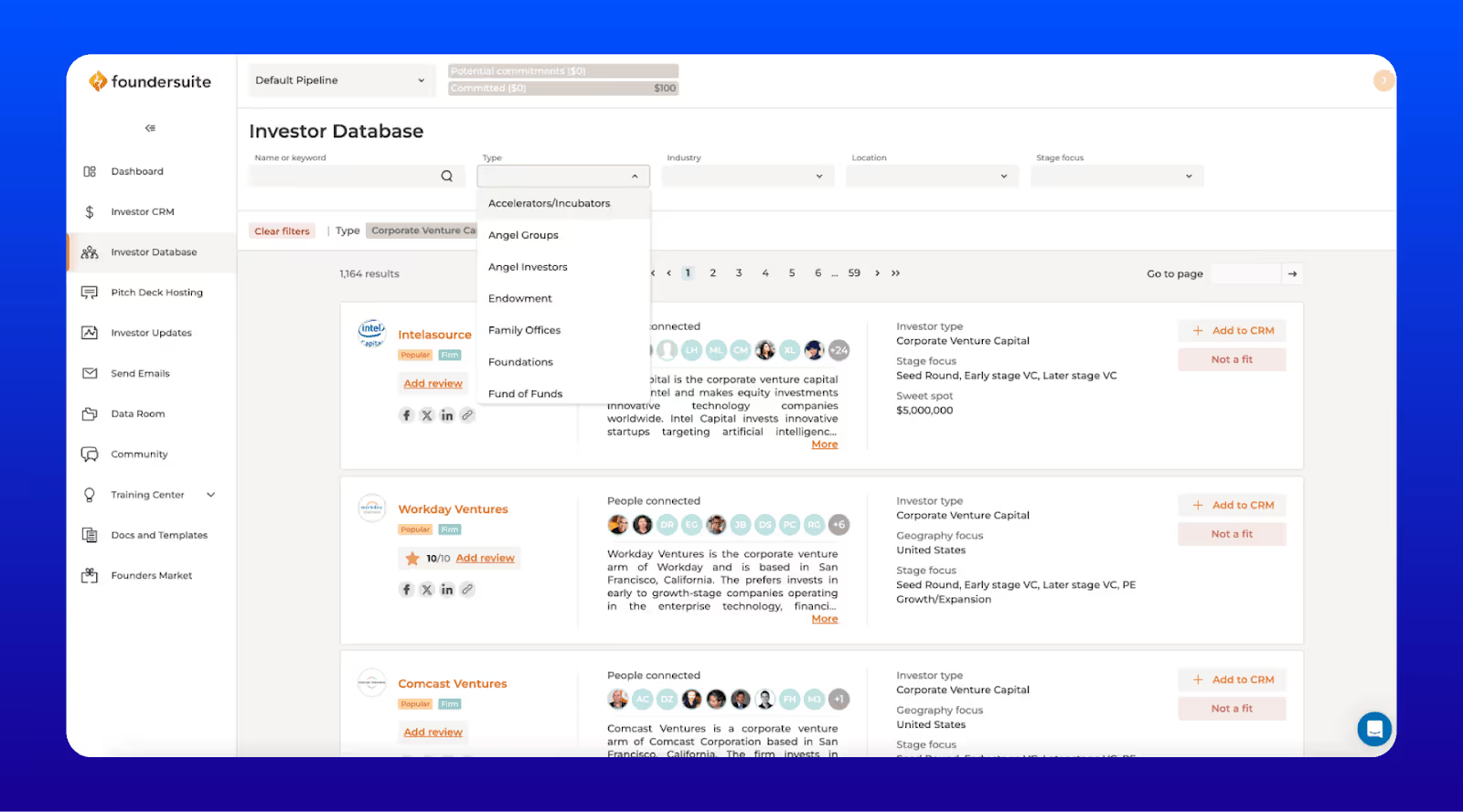

5. Foundersuite

Foundersuite is a lightweight yet powerful CRM designed specifically for managing your fundraising efforts. If you’re tired of losing track of investor emails, meetings, or follow ups, this tool is perfect for you.

While it doesn’t come with a massive investor database, Foundersuite’s simple and intuitive interface makes it easy to organize and track your outreach efforts. For startups on a budget, it’s a great way to stay on top of your fundraising pipeline.

Why Foundersuite Stands Out

- Fundraising CRM: Organize your investor outreach with a clean and simple interface.

- Templates and Tools: Access email templates, pitch deck examples, and more.

- Integration Friendly: Works with tools like LinkedIn and Gmail.

Website: https://www.foundersuite.com/

Pricing: $69/mo

Pros

- Affordable and easy to use.

- Helps you stay organized during fundraising campaigns.

Cons

- Limited database capabilities.

- Doesn’t automate investor outreach.

Wrapping Up

At the end of the day, there are tons of options when it comes to investor databases.

Just make sure that you pick the option that fits your needs best. If that’s investor activity data, Pitchbook is going to be the most in depth. And if you want to book investor meetings, LeadLoft will be the best platform as it finds contact info and can automate outreach to investors.

Regardless, hopefully this breakdown has been helpful and if you need help connecting with more investors, please feel free to connect and book a time with our team.

Good luck!

![Hottest Tech Sectors With Startup Investors [2026]](https://cdn.prod.website-files.com/5dc6051d242707b368c29acb/6691b1313d47007d513cc902_hot-sectors.avif)